Approfondimenti

News about e-invoice and abolition of "Esterometro" form starting from 1.1.2022

Starting from January 1st, 2022, sale and purchase invoices with a foreign entities not resident in Italy must be transmitted electronically in XML format, using the Exchange System (SDI). In this regard, specific codes have been introduced to identify the "code".

The complete updated list is given below:

|

TD01 |

Invoice |

|

TD02 |

Advance/down payment on invoice |

|

TD03 |

Advance/down payment on fee |

|

TD04 |

Credit Note |

|

TD05 |

Debit Note |

|

TD06 |

Professional Fees |

|

TD16 |

Reverse charge internal invoice integration |

|

TD17 |

Integration/self invoicing for purchase services from abroad |

|

TD18 |

Integration for purchase of intra UE goods |

|

TD19 |

Integration/self invoicing for purchase of goods ex art.17 par.2 DPR 633/72 |

|

TD20 |

Self invoicing for regularisation and integration of invoices (art.6 par.8 L.D. n.471/97 or art.46 par.5 L.D. n331/93) |

|

TD21 |

Self invoicing for “splafonamento” |

|

TD22 |

Extractions of goods from VAT Warehouse |

|

TD23 |

Extractions of goods from VAT Warehouse with payment of VAT |

|

TD24 |

Deferred invoice ex art.21, par.4, lect a) |

|

TD25 |

Deferred invoice ex art.21, par.4, third-period lect b) |

|

TD26 |

Sale of fixed assets and for internal transfers (ex art.36 DPR 633/72) |

| TD27 |

Self invoicing for self-consumption or for free charge invoice with VAT application |

The Tax Office, with provision no. 166579/2020, approved the “new” technical details for the issuance of electronic invoices, introducing, in particular, a new code for “Code” that can be used in case of integration/self-invoicing of electronic passive invoices.

To date, for electronic invoices identified by "Code" TD16, TD21, TD22, TD23, the obligation to send them to the Exchange System has not been introduced (instead, it is expected from January 1st, 2022 for transactions with foreign entities).

Considering the upcoming January 1st, 2022, in order to ensure the internal compliance of the invoicing cycle, some of the topics already discussed in “our” Newsletter of December 9th, 2020 are re-proposed.

Towards abolition of “Esterometro”

Pursuant to art. 1, paragraph 3-bis of Legislative Decree no. 127/2015, VAT taxpayers resident or established in Italy must transmit telematically to the Tax Office with the Esterometro, on a quarterly basis, the data relating to transactions carried out with foreign entities until December 31, 2021, excluding the transactions where the customs bills have been issued and transactions where the e-invoice has been issued. Consequently, until the 31st December 2021, the taxpayer can avoid the submission of Esterometro, issuing the electronic invoice to non-established in Italy entities, while starting from 1st January 2022 the Esterometro is abolished and so it is mandatory the electronic transmission of an invoice for the transactions with a foreign entity.

The Budget Law 2021, amended art.1 paragraph 3-bis of Legislative Decree no. 127/2015, providing for the obligation to send, by the Exchange System (SDI,) invoices issued and received to/from non-established entities.

The transmission and issuance of electronic invoices in XML format will have to be carried out with different timing and procedures according to the type of transaction, in line with the technical specifications approved by Revenue Agency Measure no. 89757/2018 (last amended by Measure no. 166579/2020).

All VAT taxpayers resident or established in Italy are required to comply with the above requirements, while taxpayers who are ntransot established in Italy but are identified for VAT purposes with direct registration or fiscal representative are exempt with the summentioned fulfillment (Questioning no. 67/E/2019, Questioning no. 104/E/2019).

As indicated in Circ. no.14/E/2019, are exempted entities operating according to:

- the c.d. "regime di vantaggio – advantage scheme" (Art. 27 co. 1 and 2 of Decree-Law 98/2011);

- flat-tax scheme for self-employed persons (Art. 1 co. 54 ff. of L. 190/2014).

Sale invoices to entities non-established in Italy

The e-invoice concerning sale transaction with non-established entities must be issued within the term provided by article 21 of P.D. no 633/72, specifically:

a.immediate invoice, within the 12° days from the execution of the supply of goods or services (the date of the document and the execution of the operation coincides). In this case, it will be advisable to issue an invoice of type TD01;

b. deferred invoice within the 15th of the following month in which the transaction is carried out, in the cases provided for in paragraph 4 of art. 21 of Presidential Decree 633/72, using invoice type TD24 or TD25. The deferred invoice can be issued in the following hypothesis:

- for the supply of goods where the delivery or shipment results from the transport document “DDT” or other documents that identify the entities between which the transaction is carried out;

- for supplies of goods made by the assignee to a third party through its own assignor; o for services provided to a taxable entity established in E.U., not subject to tax pursuant to article 7-ter;

- for services, referred to in the first sentence of the sixth paragraph of Article 6, provided to or receipt by a taxable entity established outside the European Union.

In case of issuing an e-invoice to an entity not identified in Italy, in the box "Codice Destinatario" must be indicated 7 characters "XXXXXXX" (Provision no 89757 of April 30, 2018, of the Tax Office).

On the other hand, for transactions with entities established abroad and identified in Italy, through fiscal representation or direct identification, the box "Codice Destinatario" must be reported "0000000", unless the orderer/buyer does not have a specific telematic address (pec or unique code/codice univoco).

It is specified that all electronic invoices issued by the resident or established entities must be in EURO, as provided for by art.21, paragraph 2, letter l) of DPR 633/1972, remembering to indicate in the "Divisa/currency" section 2.1.1.2 the wording "EUR".

The “nature codes” to be used for sales transactions are listed here below:

|

Type of transaction |

Regulatory reference |

Nature Code |

|

Transactions not subject to VAT under the articles from 7 to 7- septies of Presidential Decree no. 633/72 |

art. 7 a 7-septies of VAT Decree |

N2.1 |

|

Not taxable – exportations of goods (the transactions so called "triangolari/triangular"). |

Art. 8 par. 1 lect. a) e b) of VAT Decree |

N3.1 |

|

Transfer with transport or shipment outside the territory of the EU within 180 days of delivery, by the orderer or on his behalf, carried out, in accordance with the procedures established by decree of the Minister of Economy and Finance, towards Public Administrations and development cooperation subjects registered in the list referred to in art. 26 co. 3 of L. 11.8.2014 n. 125, in implementation of humanitarian purposes, including those aimed at implementing development cooperation programs. |

Art. 8 par. 1 lett. b-bis) of VAT Decree |

N3.1 |

|

The sales of goods taken from a VAT warehouse with transport or shipment outside the territory of the European Union. |

Art. 50-bis par. 4 lect. g) of L.D. 331/93 |

N3.1 |

|

Not taxable – intra Community transfers (the supply of goods for consideration transported or dispatched within the territory of another Member State, etc.). |

Art. 41 of L.D. 331/93 |

N3.2 |

|

Supply of goods to orderers, if the goods are transported or dispatched to another Member State by or on behalf of the seller, also on behalf of the orderers |

Art. 58 of L.D. 331/93 |

N3.2 |

|

Hypothesis of intra-community transfers of goods taken from a VAT warehouse with shipment to another member state of the European Union |

Art. 50-bis par. 4 lett. f) of L.D. 331/93 |

N3.2 |

|

Transaction to San Marino Republic. |

Art. 71 of VAT Decree |

N3.3 |

|

Transactions treated as export supplies (supplies of vessels used for the high seas and intended for commercial or fishing activities). |

Art. 8-bis of VAT Decree |

N3.4 |

|

International services (carriage of persons partly within the territory of the State and partly within the foreign territory depending on a single event….) |

Art. 9 of VAT Decree |

N3.4 |

|

Supplies of goods and services to diplomatic and consular offices and representatives, military headquarters of member states, etc. |

Art. 72 of VAT Decree |

N3.4 |

|

Sales, including through commission agents, of goods other than buildings and building areas, and services provided to parties who, having carried out export sales or intra-Community transactions, avail themselves of the option to purchase, including through commission agents, or import goods and services without payment of tax (upon presentation of a declaration of intent). |

Art. 8 par. 1 lect. c) e par. 2 of VAT Decree |

N3.5 |

|

Sales of goods to be introduced into VAT warehouses. |

Art. 50-bis par. 4 lect. c) of L.D. 331/93 |

N3.6 |

|

Sales of goods and services concerning goods held in a VAT warehouse |

Art. 50-bis par. 4 lect. e) of L.D. 331/93 |

N3.6 |

|

Transfers of goods from one VAT deposit to another. |

Art. 50-bis par. 4 lect. i) of L.D. 331/93 |

N3.6 |

|

Supply of services outside the EU by travel and tourism agencies (Ministerial Decree no. 340 of March 30, 1999).Prestazioni di servizi rese fuori dall'UE da agenzie di viaggio e turismo (DM 30.3.99 n. 340). |

Art. 74-ter of VAT Decree |

N3.6 |

Despite the introduction of mandatory active electronic invoicing, the obligation to send the paper format of the document to the foreign client remains.

Transactions with San Marino Republic

For the transactions with the Republic of San Marino, the provisions of the so called "Decreto Crescita” (art. 12 of Decree Law 34/2019) and the subsequent Provision of the Tax Office of August 5th, 2021 establish a transitory period started on October 1, 2021 and will end on June 30, 2022, in which electronic invoices may be issued, as an alternative to the paper format, through the Exchange System avoiding the indication of such transactions in the so-called "Esterometro".

Starting from July 1st, 2022, except in cases of exemption, the invoice may be issued only in electronic format, with a “Codice Destinatario - recipient code” registered by the Office of the Republic of San Marino "2R4GTO8".

Currently there are no clarifications about the obligation to issue electronic invoices for transactions with the Republic of San Marino carried out from January 01, 2022 to June 30, 2022 (transitory period).

However, in this transitional period, considering the regulations news on transactions with foreign subjects, it will be possible to issue electronic invoices alternatively:

- using codice destinatario/recipient code “XXXXXXX” and sending the paper invoice in duplicate to the orderer, who in turn will send one of the documents received to the San Marino tax office for endorsement;

- using codice destinatario/recipient code “2R4GTO8”, without further formalities, because the document will be received directly through SDI by the San Marino Office, which will endorse it and communicate the outcome of the control to the Tax Office.

Purchase invoices

- Purchase invoices from not established subjects

As concern purchase, the subject established in Italy who receives the paper invoice from foreign supplier, has to issue an electronic invoice in XML format by the 15th day of the month following the receipt of the document, as a prove of the operation.

The transactions with non-established subjects, for VAT purposes, are governed by art. 17 of Presidential Decree 633/72 through the mechanism of "reverse charge" which provides for the application the VAT directly on the recipient of the sale of the goods or the provision of the service, rather than on the seller, by issuing a self-invoice or an integration of the invoice.

The types of documents to be used will be listed below according to the specific case:

- TD17 “Integration/self-invoice for purchase services from abroad”

The code TD17 is used by the established orderer/buyer when receiving an invoice for services from a not established seller/service provider who does not have a permanent establishment in Italy (including residents in the Republic of San Marino or in the Vatican City State).

Filling of the invoice TD17:

- seller/service provider box: data of the foreign supplier with the indication of the foreign country;

- orderer/buyer box: data of the subject who carry out the integration or self-invoicing;

- box 2.1.1.3 <Data/Date> of the "General Data" section of the electronic invoice file must be reported:

- the date of receipt (or, in any case, a date in the month of receipt the invoice issued by the foreign supplier), in case of issuing of the supplementary document related to the purchase of intra-EU services;

- the date of execution of the transaction, in the case of issue of the self-invoice relating to the purchase of non-EU services or purchase of services from a Republic of San Marino or in the Vatican City State supplier.

- indication of the taxable amount in the invoice sent by the seller / service provider and the VAT calculated by the orderer /buyer, or the nature code if it is not a taxable transaction (for example, code N3.4 in the case of non-taxable and code N4 in the case of exemption);

- indication in box 2.1.6 of the details of the reference invoice and, when available, the IdSdi attributed at the invoice by the Exchange System;

- box 2.1.1.4 "Numero/Number": it is advisable to use an ad hoc progressive numbering;

- box 2.2.1.4. " Descrizione/Description" in case of:

- integration of the invoice received from EU subjects, it is necessary to indicate the VAT normative reference. "Integrazione ai sensi dell’art.17, comma 2 del D.P.R. 633/1972";

- self-invoice of the service from a non-EU subject, it is necessary to report in detail what is indicated in the description of the invoice received with reference to the services purchased, also reporting the following text: " Autofattura ai sensi dell’art. 17, comma 2 del D.P.R. 633/1972".

In both cases, it is advisable to attach in box 2.5. "Attachments" is the invoice received from the foreign supplier of services.

- TD18 “Integration for purchase of intra UE goods”

The code TD18 is used by the resident orderer/buyer when receiving an invoice for goods purchased from a seller/service provider resident in another UE country.

Filling of the invoice TD18:

- seller/service provider box: data of the foreign supplier with the indication of the foreign country;

- orderer/buyer box: data of the subject who carry out the integration;

- box 2.1.1.3 <Data/Date> of the "General Data" in the electronic invoice file is mandatory to report the date of receipt (or, in any case, a date in the month of receipt of the invoice issued by the foreign supplier);

- indication of the taxable amount in the invoice sent by the seller/service provider and the VAT calculated by the orderer /buyer, or the nature code if it is not a taxable transaction (for example, in the case of non-taxable purchases with the use of the Plafond it is necessary to indicate N3.5; in the case of introduction of goods into a VAT Warehouse following an intra-Community purchase it is necessary to indicate the nature N3.6; in the case of exempt purchases it is necessary to indicate the nature N4);

- indication in box 2.1.6 the details of the reference invoice and, when available, the IdSdi attributed at the invoice by the Exchange System;

- box 2.1.1.4 " Numero/Number”: it is advisable to use an ad hoc progressive numbering;

- box 2.2.1.4. " Descrizione/Description”: it is necessary to indicate the VAT normative reference of the art. 46, par. 1 of Law Decree n. 331/1993.

It is advisable to attach in the box 2.5. "Attachments" the invoice received for the goods purchase.

- TD19 “Integration/self - invoicing for purchase of goods ex art.17 par.2 DPR 633/72”

The code TD19 used by the resident orderer/buyer for goods purchase, already sited in Italy, from a subject UE or extra-UE (neither imports nor intra-EU purchases are considered), for which the taxable subjects is the Italian subject and is required to apply VAT with the integration or self-invoicing procedure, according to whether the supplier is established in EU or extra-EU country.

The transmission to the SDI of this type of document also in the case of issue a self-invoicing, in according to art.17, paragraph 2, of the D.P.R.633/1972, for the purchase of goods from the Republic of San Marino or from the Vatican City State.

Filling of the invoice TD17:

- seller/service provider box: data of the foreign supplier with the indication of the foreign country;

- orderer/buyer box: data of the subject who carry out the integration or self-invoicing;

- box 2.1.1.3 <Data/Date> of the "General Data" section of the electronic invoice file must be reported:

- the date of receipt the invoice issued by the UE supplier (or date in the month of receipt of the invoice issued by the supplier);

- the date of execution of the transaction with the non-EU supplier or with a supplier from the Republic of San Marino or in the Vatican City State, in the case of self-invoicing.

- indication of the taxable amount in the invoice sent by the seller / service provider and the VAT calculated by the orderer /buyer, or the nature code if it is not a taxable transaction for example, for non-taxable goods with use of the plafond it is necessary to indicate N3.5, purchases from non-established subjects of goods already present in Italy with introduction in a VAT Warehouse (article 50-bis, paragraph 4, letter c) or for purchases from non-established subjects of goods (or services on goods) inside a VAT Warehouse it is necessary to indicate the nature N3.6;

- indication in the box 2.1.6 the details of the reference invoice and, when available, the IdSdi attributed at the invoice by the Exchange System;

- box 2.1.1.4 "Numero/Number": it is advisable to use an ad hoc progressive numbering;

- box 2.2.1.4. "Descrizione/Description" in case of:

- integration of the invoice received from EU subjects, it is necessary to indicate the VAT normative reference. "Integrazione ai sensi dell’art.17, comma 2 del D.P.R. 633/1972";

- self-invoice of the service from a non-EU subject, it is necessary to report in detail what is indicated in the description of the invoice received, reporting the following text:

"Autofattura ai sensi dell’art. 17, comma 2 del D.P.R. 633/1972".

In both cases, it is advisable to attach in the box 2.5. "Attachments" the invoice received for the purchase services.

- TD20 Self invoicing for regularisation and integration of invoices (art.6 par.8 L.D. n.471/97 or art.46 par.5 L.D. n331/93)

In the case of a UE purchase of goods as referred to article 38, paragraphs 2 and 3, letters b) and c), a purchase of services provided by an EU supplier or purchase of goods already sited in Italy from an EU supplier, the orderer/buyer who has not received the invoice by the end of the second month following the month in which the transaction was carried out, or has received an invoice indicating a lower amount, it is mandatory to issue a self-invoicing/integration with "Code" TD20 by the Exchange System.

Filling of the invoice TD20:

- seller/service provider box: data of the foreign supplier who have not issued the invoice or have issued the invoice with an amount lower;

- orderer/buyer box: VAT identification of the subject carrying out the regularisation or integration;

- box 2.1.1.3 <Data/Date> of the "General Data" in the electronic invoice file is mandatory to report the date of goods or services purchase, in accordance with the art. 21, par. 2 D.P.R.633/1972;

- an indication of the taxable amount not invoiced by the seller /service provider or the correct taxable amount and for both the VAT calculated (or the nature in the case of not a taxable transaction or exemption);

- indication in box 2.1.6 of the details of the reference invoice, only in the case of irregular invoice by the supplier;

- box 2.1.1.4 " Numero/Number": it is advisable to use an ad hoc progressive numbering.

We specify that all electronic invoices are mandatory expressed in EURO, in accordance with art. 21, paragraph 2, letter l) of Presidential Decree 633/1972, remembering to indicate in the box 2.1.1.2 "Divisa/Currency" the text "EUR". For the invoice received in foreign currency, it will therefore convert the amount of the transaction into Euros on the date of execution of the operation or, without that, on the date of the invoice received.

Other operations that provide the invoice integration or the self-invoicing

As highlighted in the introduction, for transactions characterized by the code "TD16, TD21, TD22, TD23" from 1 January 2022 it is not mandatory to send them to the Exchange System (SdI).

However, it is considered useful to examine the individual cases also for the future provision by the Tax Office of the pre-filling drafts of the VAT registers (sales and purchases) and of the periodic VAT settlements (Lipe), as well as of the annual VAT return (article 142 Law decree n. 34/2020) considering that, the electronic submission of this type of invoices, will allow the Tax Office to make the pre-filling declaration with a greater detail available.

It should be noted that an "electronic" management of these invoices would facilitate the electronic storage of fiscal documents with a consequent reduction in paperwork.

- TD16 Invoice integration from internal reverse-charge

In case of receipt by resident seller/service provider of an e-invoice subject to the "Internal reverse-charge" regime, characterized by nature codes from N 6.1 to N6.9, the orderer/buyer could integrate the invoice by sending an e-invoice to the Exchange System (SdI) using the TD16 code.

Filling of the TD16 document:

- seller/service provider: data of the supplier that issued the reverse charge invoice;

- orderer/buyer box: data of the subject that carrying out the integration;

- in the box 2.1.1.3 <Data/Date> of the “General Data” section of the e-invoice file, the date of receipt the invoice with reserve charge or, in any case, a date in the month of receipt the invoice issued by the supplier;

- indication of the taxable amount in the invoice sent by the seller / service provider and the VAT calculated by the orderer /buyer (in case of different rates, the document will be fill in with the individual taxable amounts and individual taxes);

- the box 2.1.1.4 “Numero/Number”: it is advisable to use ad hoc progressive numbering.

- TD21 “Self- invoicing for “splafonamento”

If the usual exporter, who purchases with a DOI (Declaration of intent), exceeding the limit set by the available plafond (identified through a DOI), could to correct the situation by issuing a self-invoicing, and transmit it through SDI an invoice with code TD21.

Filling of the TD21 document:

- seller/service provider: the data of subject who issues the self-invoicing;

- orderer/buyer: the data of subject who issues the self-invoicing;

- In box 2.1.1.3 <Data/Date> of the "General Data" section of the electronic invoice file it is mandatory to report the date when the regularization is carried out, which is mandatory in any case, in the same year of exceeding the plafond available;

- indication of the amount exceeding the plafond and the VAT;

- indication of the reference invoice in box 2.1.6. in case that the exporter issues a different self-invoicing for each supplier;

- box 2.1.1.4 “Numero/Number”: ad hoc progressive numbering is recommended.

- Extractions of goods from VAT Warehouse

The integration or self-invoicing for the operations of extraction of goods from VAT warehouse typically is not subject to the mandatory of electronic invoicing.

However, it should be note that the goods placed in free circulation in a VAT warehouse are not subject to VAT, while the extraction, even if carried out by the same subject that introduced the goods, involve the VAT fulfilment with annotation in the register in accordance with the art. 25 of Presidential Decree no. 633/72 (purchase register), of the invoice issued as provided to art. 17, paragraph 2, of the same Decree (called "self-invoicing").

The Note of the Agency of Customs and Monopolies of July 12, 2019 specifies that in the case of there is no correspondence between the value of the good introduced in the VAT Warehouse and the good extracted, because increased by the services expenses referred to it, the self-invoicing issued in the same moment of the extraction is no longer just an integration of another document, but a document designed to identify the value of the good extracted and the correct tax base.

Therefore, in this specific case, for the self-invoicing is mandatory to follow the general rules and issued electronical invoice through the Exchange System.

- TD22 Extractions of goods from VAT Warehouse

In case the VAT subject proceeds with the extraction from the VAT Warehouse of goods (for the use and sell in Italy) previously introduced following an intra-community purchase (CASE A) or placing in free circulation, in accordance with art. 50-bis, paragraph 6, of the D.L. n. 331/1993 (CASE B). In both case A and B, two sub-cases could disclose, that change if the subject who extracts the goods from the VAT warehouse is the same as the one who introduced them (CASES A1 and B1) or is a different subject from the one who introduced goods. (CASES A2 and B2).

Please refer to the GUIDE for the E-invoice attached to this circular for further details. (Attachment n.1)

- TD23 Extractions of goods from VAT Warehouse with payment of VAT

In case the VAT subject proceeds with the extraction from the VAT Warehouse (for the use and sell in Italy) of goods introduced in accordance with the Art. 50-bis, paragraph 4, lett. c) of the DL n. 331/1993 (sales of goods already in Italy with introduction in a VAT warehouse), issues a self-invoicing in accordance with Art. 17, second paragraph of the DPR n. 633/72 and the VAT is paid, in its name and on its behalf, by the deposit manager through the form F24 in the name of the subject who extracts, within the 16th day of the month following the extraction. Otherwise, it is possible to proceed with the goods extraction without paying the tax using the available plafond.

Two sub-cases could be presented and depending on whether the subject who extracts the goods from the VAT warehouse is the same as the one who introduced them (case A1) or is a different subject from the one who introduced them (case A2).

Please refer to the GUIDE for the E-invoice attached to this circular for further details. (Attachment 1)

***

Note: The documents sent to the SdI issued by a different subject from the seller-service provider as they are generated by the orderer/buyer through the issuance of an integration or a self-invoicing, is suggested to indicate in the box 1.6. "Soggetto emittente/Issuer" the text "CC" (orderer/buyer). The above also considering the answer to FAQ 140 of 07/19/2019 published by the Tax Office. Considering the recent news described above, it is desirable an addicted clarification or confirmation by the Tax Office.

We attach a summary table of all the cases described in this circular (Attachment 2).

Penalties

Following the changes by the legislator, the penalties applicable to non-compliance with the provisions, for transactions carried out from 1 January 2022, are set at Euro 2.00 for each invoice, up to a maximum limit of Euro 400.00 monthly. The penalty is reduced by half, within the limit of Euro 200 monthly, if the transmission is carried out within 15 days following the deadlines or if, within the same term, the correct transmission of the data is carried out.

Renewal of the Tax Office storage service

In according to art. 39 of DPR 633/72, electronic invoices are mandatory to store electronically, in accordance with the provisions of the Digital Administration Code (CAD).

For all who have activated the storage service offered by Tax Office, please note that the agreement "Subscription to the Service Agreement for the storage of electronic invoices provided by art. 1 of Legislative Decree 127/2015." expected a duration of 3 years, starting from the date of subscribe.

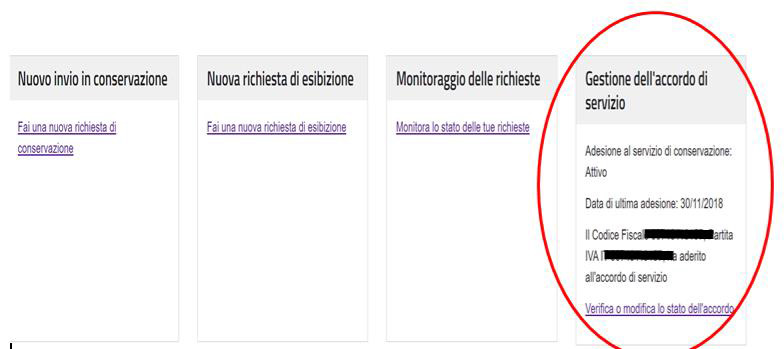

It is therefore advisable for who have subscribed the service, to check deadline date of the agreement and renew it in the "Reserved Area" of the "Fatture e Corrispettivi" web portal:

- selection the link “Fatture elettroniche e Conservazione”;

- accessing the section “Conservazione” and to click “Accedi alla sezione conservazione”;

- “Verifica o modifica lo stato dell’accordo” in the area Gestione dell’accordo di servizio.

Attachment 1: Guide for the E-invoice version 1.5

Attachment 2: Summary scheme

Attachment 3: Table representation of the ordinary invoice version 1.6.3 in .xls

Attachment 4: Technical specifications link: https://www.agenziaentrate.gov.it/portale/web/guest/specifiche-tecniche-versione-1.6.3