Approfondimenti

THE NEW ITALIAN PLASTIC -TAX

In according to Law Decree n. 160/2019, the Customs and Monopolies Agency will have to provide at the publishment of a directive to implement the new tax and to help the payable subjects to individuate

the principal aspects of the plastic-tax. The Customs and Monopolies Agency has provided to publish a

draft to individuate in the detail the object of the tax, the taxable subjects and their fulfilments, the

content of trimestral declaration, and how to request the refund.

Following we will individuate the main aspects of plastic-tax.

The object of plastic-tax

The plastic tax is aimed at deterring the use of plastic materials, in fact, it is applied at the single-use plastic (c.d. MACSI) used for containment, protection, manipulation, or delivery of goods or food products.

The plastic tax, according to article n.1 ph. 634-652 of Law Decree n. 160/2019, is applied to consumption of MACSI – Manufactured products for single use:

- realized totally or in part of plastic materials of synthetic organic polymers (is therefore also applied to those products composed of plastic with papers, cardboards, metals, or other);

- not designed or placed on the market to carry out more than one transferor to be reused for the same purpose;

- which to have the function or are used to containment, protection, manipulation, or delivery of goods or food products.

The manufactured products taxed have this main characteristic:

- are made in the form of sheets, cling films, or strips with the use of plastic materials of synthetic organic polymers included on the customs headings of the combined EU nomenclature: 3901 (Polymers of ethylene, in primary forms:), 3902 (Polymers of propylene or of other olefins, in primary forms), 3903 (Polymers of styrene, in primary forms:), 3904 (Polymers of vinyl chloride or of other halogenated olefins, in primary forms), 3905 (Polymers of vinyl acetate or of other vinyl esters, in primary forms; other vinyl polymers in primary forms), 3906 (Acrylic polymers in primary forms), 3907 (Polyacetals, other polyethers and epoxide resins, in primary forms; polycarbonates, alkyd resins, polyallyl esters, and other polyesters, in primary forms), 3908 (Polyamides in primary forms) 3909 (Amino-resins, phenolic resins, and polyurethanes, in primary forms), 3910 (Silicones in primary forms) e 3911 (Petroleum resins, coumarone-indene resins, polyterpenes, polysulphides, polysulphones and other products specified in note 3 to this chapter, not elsewhere specified or included, in primary form).

- not designed or placed on the market to carry out more than one transfer during their life cycle or to be reused for the same purpose.

The taxable subject

The subjects that are mandatory to pay the plastic tax, are the following categories:

- the manufacturer, for MACSI, realized in the national territory (are not considered manufacturers the subjects that produce MACSI using other MACSI on which the tax is payable by another entity, without the addiction of additional plastics). As clarified by the Assonime circular n.5/2021 the Budget Law for fiscal year 2021, modified the paragraph 637, has included in the taxable subjects for MACSI produced in Italy, “the subject, resident or not resident in the national country, that sells MACSI, obtained for its behalf in production facilities of other Italian subjects.” This subjectivity excludes the taxable subjects who perform the manufacturing and obtain the MACSI, under project contract or subcontract. In other words, it excludes the entity that made the manufacture, so in this way, the payment of tax not has a duplication. In accord with the interpretation of Assonime the tax subjectivity of the manufacturer, the entity that realized the manufactures in its facilities, would be limited to cases in which these subjects utilized directly goods realized for their function, to contain, to protect, to handle, or to deliver goods or food products.

- the EU purchaser, with economic activity, for MACSI that come from by other EU countries;

- the EU seller, if MACSI come from by other countries and boughy by private consumers;

- the importer, for MACSI, come from other countries;

- the seller, resident or not resident in Italy, that wants to sell MACSI at other Italian subjects, made on its behalf in production facilities of another entity (with project contract or subcontracts). In this sense, the taxable subject is not who made MACSI for others.

In the case of the subjectivity of the plastic tax for foreign subjects, not resident or not established in the Italian country, are required to appoint a tax representative, obligated jointly with the same. In the letteral interpretative of the rule seems to be excluded the possibility for the foreign entity to absolve the tax through direct representation (art.35-ter of D.P.R. n. 633/72). In this regard, the circular Assonime n. 5/2021 observes “the Court of justice pronounced more times that the mandatory to appoint a tax representative is a restriction of free movement of capital. The prevision of joint subjectivity of the representative makes it even clearer the possibility of a conflict with European Union principles”.

It should be noted that if the manufacturer sells or directly export the MACSI for consumption in other EU countries or extra-EU, the tribute is not due.

Moreover, the tax is not due by the importer for MACSI contained in the shipping in the application of the customs duty (European Regulation n.1186/2009).

The main fulfilments

In the draft of the Customs and Monopolies Agency directive individuates the necessary fulfilments for the plastic tax.

The payable subjects are mandatory:

- to register the entity in the platform of Customs and Monopolies Agency and then to submit an initial communication called “technical report”, where are required the identification data of the entity, the list of types of MACSI produced with specific identification if the MACSI is excluded, then a description of technical characteristics of the facilities for every MACSI, the management of raw materials storage (virgins or recycles) and MACSI, the procedures of the industrial accountant of the facilities.

The initial communication presented by the seller shall be indicated the location of the production facilities where the processes of MACSI production are carried out on its behalf.

- To have an identification code issued by Customs and Monopolies Agency after the presentation of initial communication;

- To pay the tax indicated in the quarterly declaration with the model F24;

- To keep the daily accounts for the production facility, instead for the seller to keep a weekly account for every production facilities;

- To issue the invoice with necessary data to calculate the plastic tax included in the total amount, in particular: the nature, quality, and quantity of MACSI sold with specific indication of which MACSI is excluded, the virgin plastic mass inside MACSI, and the amount of tax paid.

For the EU sellers, these fulfilments will have to be done through an own tax representative nominated in Italy.

The importers are excluded from fulfilments above, with an exception of the payment of tax, that will pay at the moment of importation with DAU:

- Indicating in the box 33 the code Z050 if the MACSI imported are the object of plastic tax (as in part) or the code Z051 if the MACSI are excluded of the tax;

- Liquidating in box 47 the amount of plastic tax.

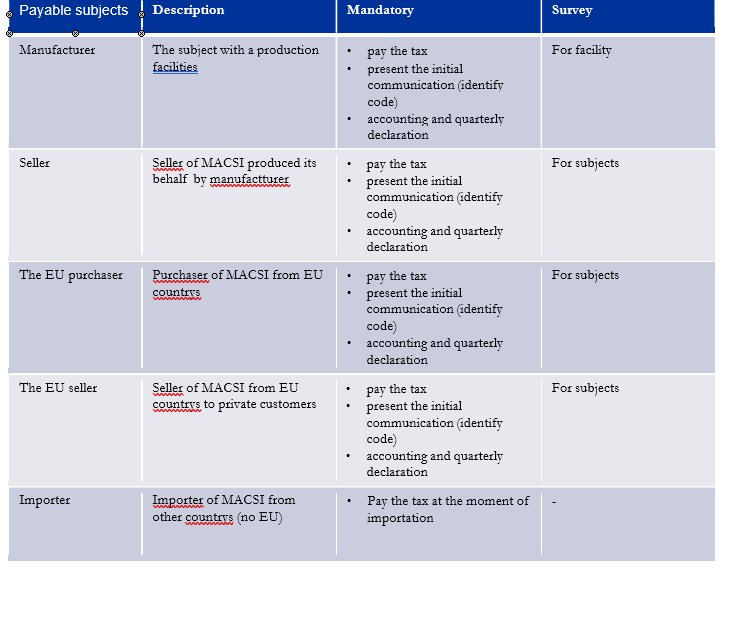

The table below is the summary of fulfilments of the subjects that pay plastic tax:

The method of plastic tax payment

The plastic tax is established in euro 0,45 for a kilogram of plastic materials included in MACSI. The tax obligation is at the moment of production, importation in the Italian territory, or the introduction in the same territory from other EU countries.

The tax is due when the MACSI was introduced in the consumption process in Italy, in the specific, the moment is individuated at:

- the transfer to other Italian subjects by Italian entity for MACSI realized in Italy;

- the introduced in the Italy MACSI from other EU countries: in the case of purchase by Italian entity with economic activity and in the case of supply by EU entity to a private Italian consumer;

- The moment of import in Italy for MACSI from other extra-EU countries.

It should be noted that the article n.1 ph.639 of Law 160/2019 considers introduced in the consumption process the MACSI that contain goods or food products. The letteral interpretation of the rule could mean that the tax is applied for MACSI introduced in Italy with importation by other countries, or from EU countries, used as the packaging of other goods. On this point, however, it is hoped that it will be clarified by the plastic tax final directive.

The liquidation of plastic tax is through the presentation of a quarterly declaration at the Customs and Monopolies Agency within the end of the following month a quarterly declaration was presented.

The EU purchaser that sold MACSI at the final customer resident in Italy, it is mandatory to submit the

quarterly declaration through the tax representative, that is responsible for the tax payment with the purchaser and manufacturer of MACSI.

The tax is mandatory to pay with the F24 model within the end of the following month at the quarterly declaration that was presented, moreover, the tax can be paid with compensation of other credit tax or contributions. To specific, the deadline to present the declaration and to pay the tax is the same.

If the amount of plastic tax is equal to or less than 25 euros, the taxable subject is exempt to pay this tax.

The Law n.160/2019 ph. 642 is recognized the possibility for taxable subjects to ask for a refund if the tax

that has to pay was not due.

It is the case of export or EU sales of MACSI that have bought before from the manufacturer that pays

the tax. The manufacturer has paid the plastic tax because is one of the taxable subjects individuated above by the draft of the Customs and Monopolies Agency and it charges the tax into the sale invoices.

The assumption of territoriality of plastic-tax is not respected, the MACSI is not introduced in the consumption process in the Italian territory (as the rule required), therefore the tax is refunded for the

exporter or the subject that sold in the EU countries. To request the refund is necessary that the tax is highlighted in the commercial documents and it is provided proof of payment.

Discipline of refunds

The requirement for a refund is presented at the Customs and Monopolies Agency within two years by the date of payment, with annex, the purchase invoices of MACSI where is indicated the tax payment and the indication if the refund required is in cash or tax voucher. Instead, the limit of the prescription to recover the credit required at refund is 5 years.

Penalities

The unrespect of the dispositions listed above implicate the application of administrative penalties:

- in the case of nonpayment of the plastic tax is applied the penalties from double to five times of the tribute, anyway, it is not ever less than 250 euro;

- in the case of late payment, the penalty will be at 25% of tribute due, anyway it is not ever less than 150 euro;

- in the case of late submission of quarterly declaration and every other violation, with regard to plastic-tax, is punished with a penalty from euro 250 to euro 500.